This guide will explore:

- Common risks on an African safari

- What to look for in a policy

- Top insurance providers

- Tips for getting coverage

Safari Dangers: Assess Your Risk

While inherently thrilling, safaris also carry inherent risks. Before purchasing insurance, make an honest assessment of the potential hazards.Remote locations: Safaris venture far from main cities into remote wilderness, making rapid emergency evacuation difficult. Medical facilities in national parks and reserves are sparse.

Rough travel: Bumpy roads, dusty trails, river crossings, and off-road adventures are par for the course on African safaris. The rugged conditions increase the chances of accidents and physical injuries.

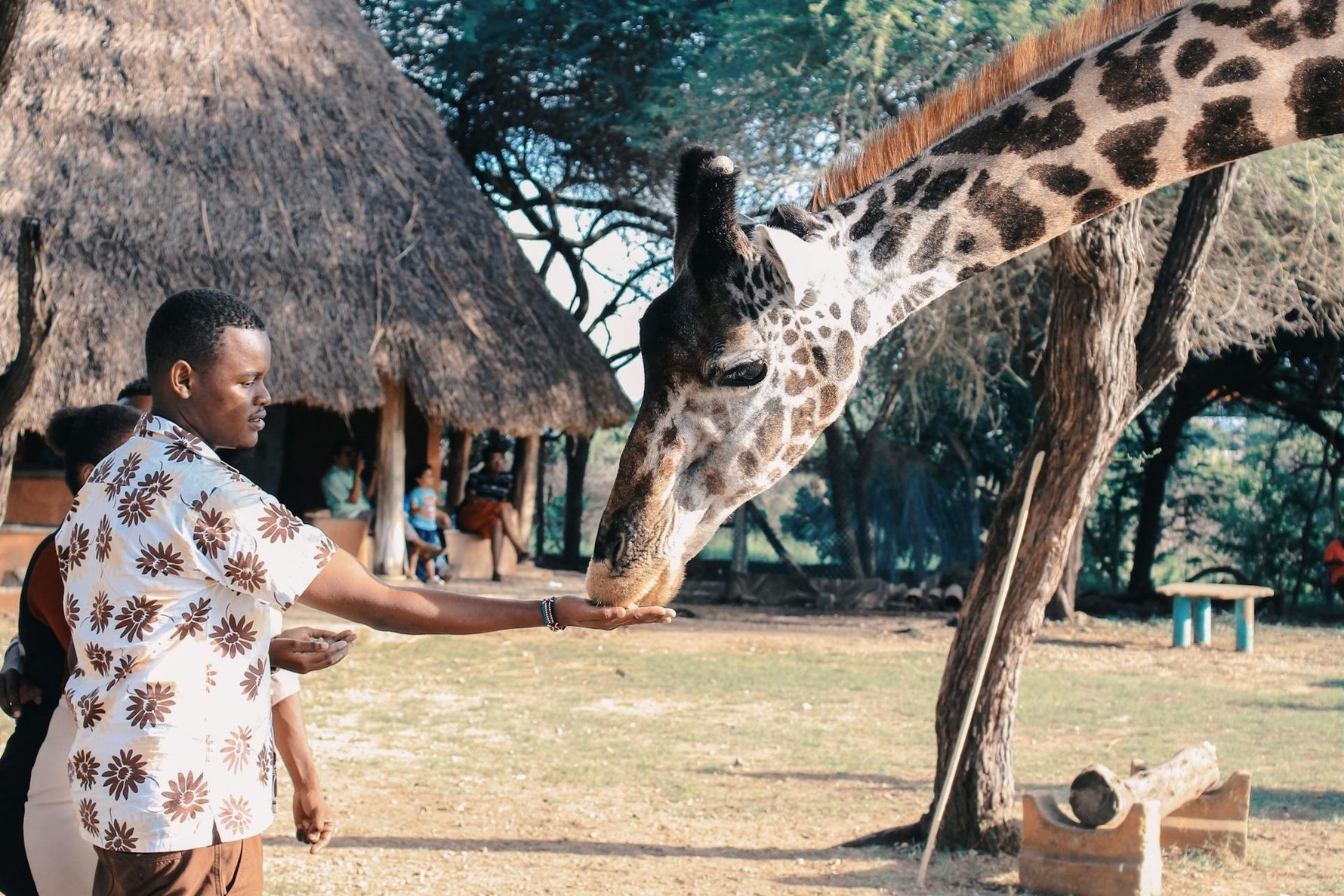

Wildlife encounters: A safari highlight is getting close to untamed animals in their native environment. But wildlife behaves unpredictably. Large animals like elephants, hippos, buffalo, and lions can be dangerous, and bites, stings, and other injuries are possible.

Extreme weather: Safari destinations have extreme weather fluctuations. Torrential rain, flooding, droughts, heat waves, and more can instantly impact your trip.

Illness risks: New food, water sources and unfamiliar germs raise the chances of contracting travel-related illnesses and diseases, including malaria, in remote areas.

Types of Safari Travel Insurance

Standard trip protection plans sometimes meet the specialised needs of safari travellers. Look for policies designed specifically for safaris and exotic locales that offer higher coverage levels.Medical Insurance: Medical coverage is a top priority. Policies cover costs related to accidents, injuries, illnesses, diseases, evacuations, and more, providing emergency transport to quality hospitals, doctors you trust, and immediate payment guarantees so you can focus on recovery.

Emergency Services: Look for 24/7 travel assistance to access medical referrals, prescription replacement, lost document help, emergency cash transfers and phone translation services.

Accidental Death: This policy provides a payout to beneficiaries in the rare event of death during the trip. It is especially prudent for adventurous travellers.

Travel Delay: It reimburses expenses like accommodations, transport, and food if bad weather or other unforeseen problems delay your trip en route to Africa or during the safari.

Cancellation Protection: It refunds prepaid trip costs should you need to cancel due to covered reasons like sickness, injury, employment loss, terrorist incident, or supplier default. It also lets you reschedule for a future date.

What to Look For in a Safari Insurance Policy

With countless options on the market, examine the policy fine print to ensure you get the features and coverage levels you need.Sufficient coverage limits: Examine medical and evacuation caps. Rs 1 crore or more policies are preferable for Africa's high-cost medical care. There is no upper limit on evacuation insurance.

Emergency medical transport: Confirm that the insurer can rapidly coordinate emergency transport from your remote location to a hospital abroad if necessary.

24/7 travel assistance: Look for round-the-clock access to medical and travel coordination services. This should include referrals to English-speaking doctors.

Hazardous activity coverage: Standard policies may exclude injuries from "high-risk" safari adventures like horseback riding, mountain climbing, scuba diving, and even shared safari vehicle game drives. Choose a plan that covers your safari plans.

Pre-existing condition waiver: A waiver lets you cover pre-existing medical issues that typical insurers exclude. It is ideal for travellers with chronic conditions.

Tips for Getting Safari Insurance

Protect your African dream vacation by following these safari travel insurance buying tips:Purchase early: To get maximum cancellation and pre-trip protection, buy your policy within 1-2 weeks of booking your safari.

Read the fine print: Understand exclusions, limits, and deductibles so you don't face surprises later if you need to file a claim.

Get medical evacuation: Confirm the policy includes emergency medical evacuation from remote areas. This is a must!

Compare carefully: Safari policies vary widely, so compare benefits, exclusions and pricing.

Disclose pre-existing conditions: Be upfront about any pre-existing medical issues when applying to avoid claim denial later.

Comments